March 2023 – Three years after the World Health Organization designated COVID-19 a global pandemic, a full recovery is finally in sight for the global travel and tourism industry—the earliest and hardest-hit sector of the economy. China’s lifting of its coronavirus controls puts the last piece in place to push global travel above its 2019 levels and provides timely impetus to a maturing rebound.

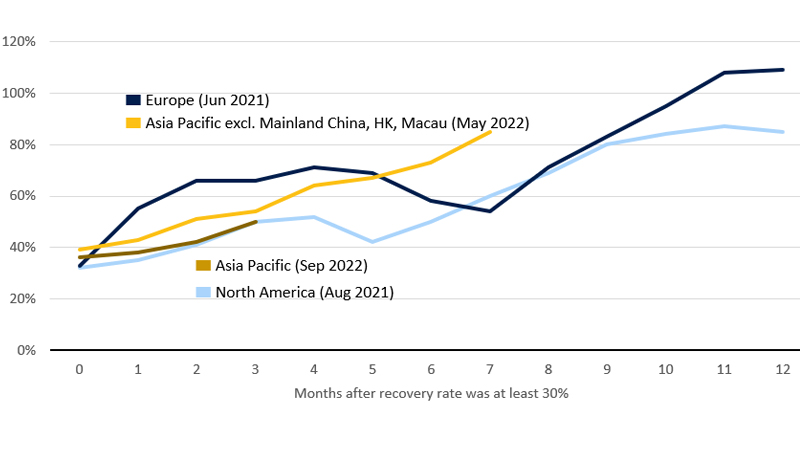

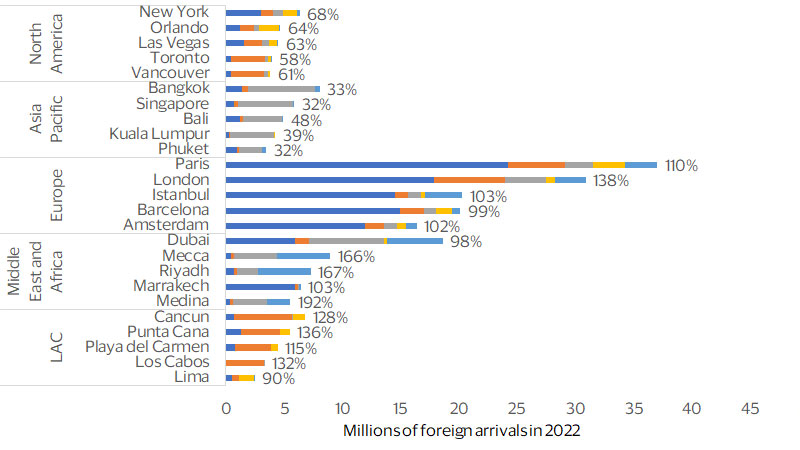

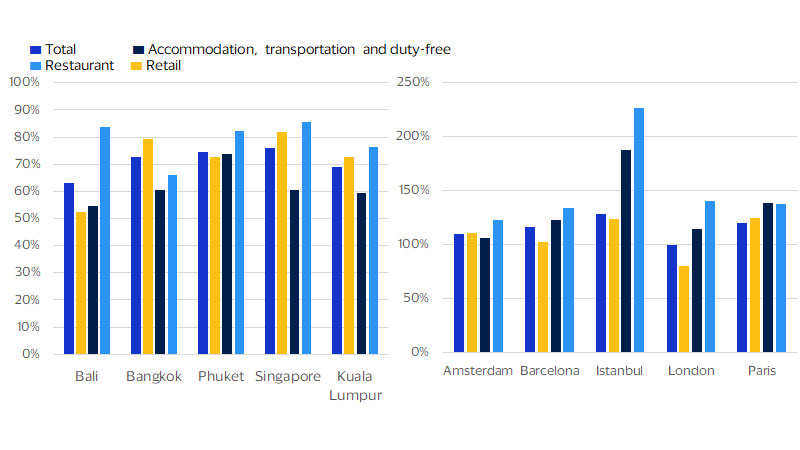

On its current trajectory, Asia Pacific monthly outbound travel could match its 2019 levels as early as this July. Our projection is grounded in the Visa International Travel (VISIT) platform,¹ which enables comparisons of Asia Pacific’s travel recovery to that of other regions. In this context, Asia Pacific is well-positioned for such a swift recovery, especially after a weak 2022 in which it reached only 27 percent of its 2019 volume. With Asia Pacific back and now looking forward to a full year of relatively unimpeded travel ahead, international travel arrivals will likely exceed 1 billion for the year, from nearly 890 million in 2022. As the recovery proceeds, the mix of key international travel destinations is also set to change. Destinations in Asia Pacific, which had been closed to foreign travelers during the pandemic, could reclaim lost visits. This should help to reduce the pressure that has been building on other destinations in their absence. Moreover, the so-called ‘revenge travel spending’ seen in the initial recoveries of other regions is now occurring with Asia Pacific travelers, helping to inject an additional source of revenues into their travel destinations.